|

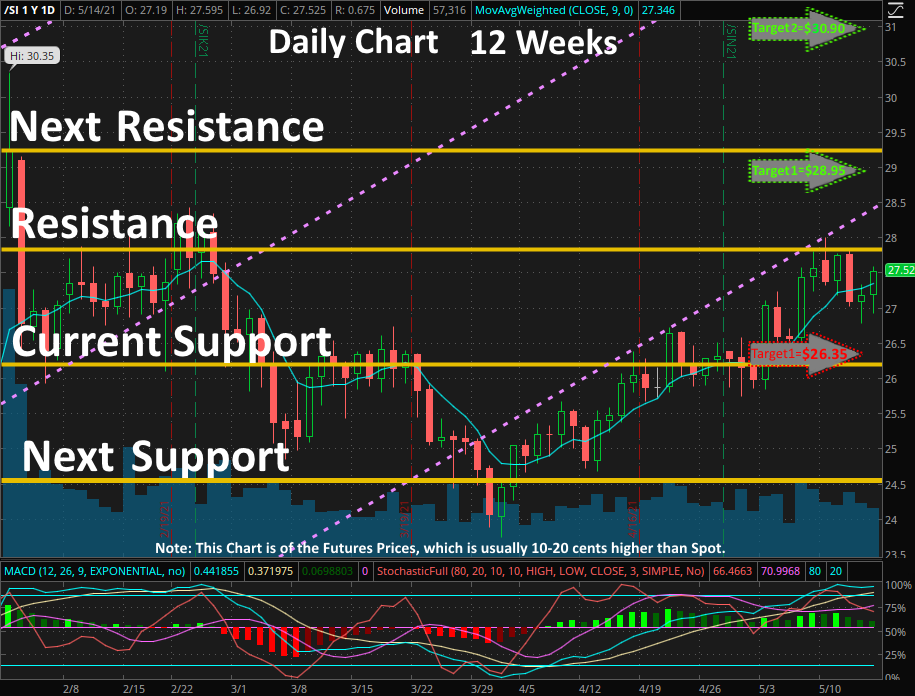

Sunday AM Vision: Week of May 16 - May 22, 2021

|

|

Sunday AM Vision: Week of May 9 - May 15, 2021

|

|

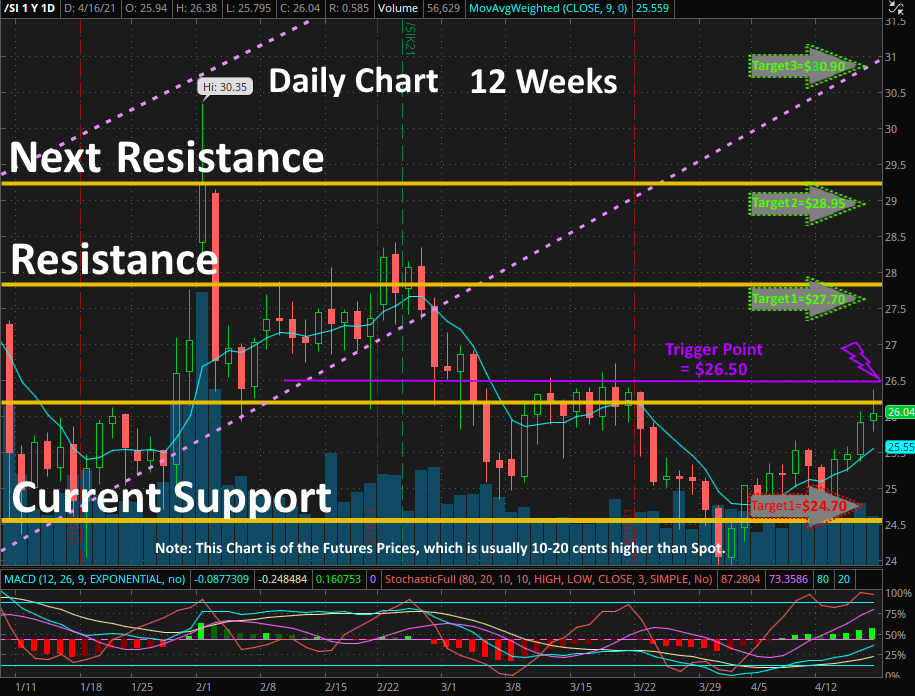

Sunday AM Vision: Week of April 18 - April 25, 2021

|

|

Sunday AM Vision: Week of April 11 - April 17, 2021

|

|

Sunday AM Vision: Week of April 4 - April 10, 2021

|

|

Sunday AM Vision: Week of March 28 - April 3, 2021

|

|

Sunday AM Vision: Week of March 21 - March 27, 2021

|

|

Sunday AM Vision: Week of March 14 - March 20, 2021

|

|

Sunday AM Vision: Week of March 7 - March 13, 2021

|

|

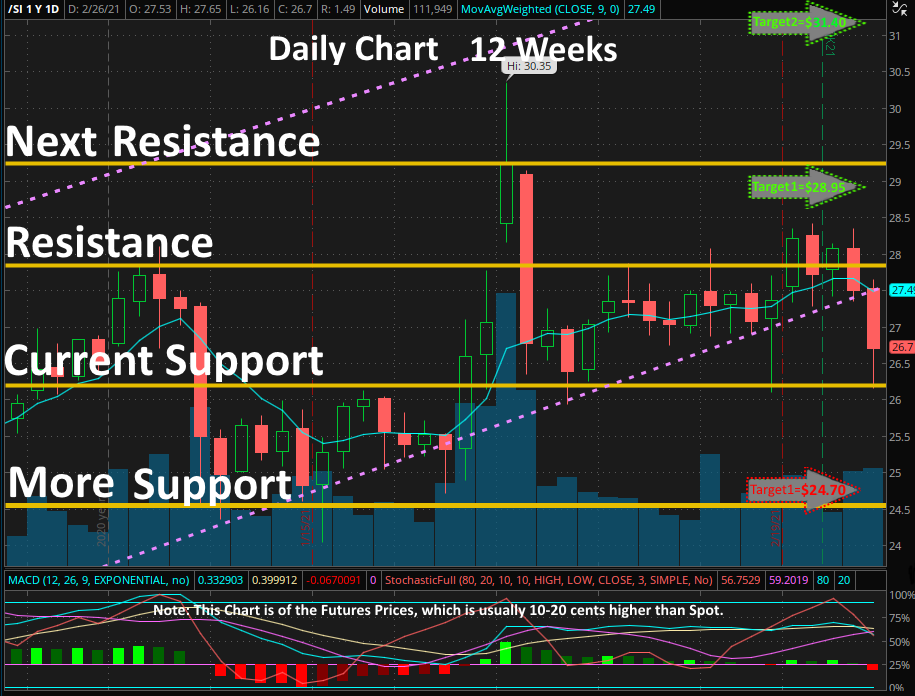

Sunday AM Vision: Week of February 28 - March 6, 2021

|

|

Sunday AM Vision: Week of February 14 - February 20, 2021

|

|

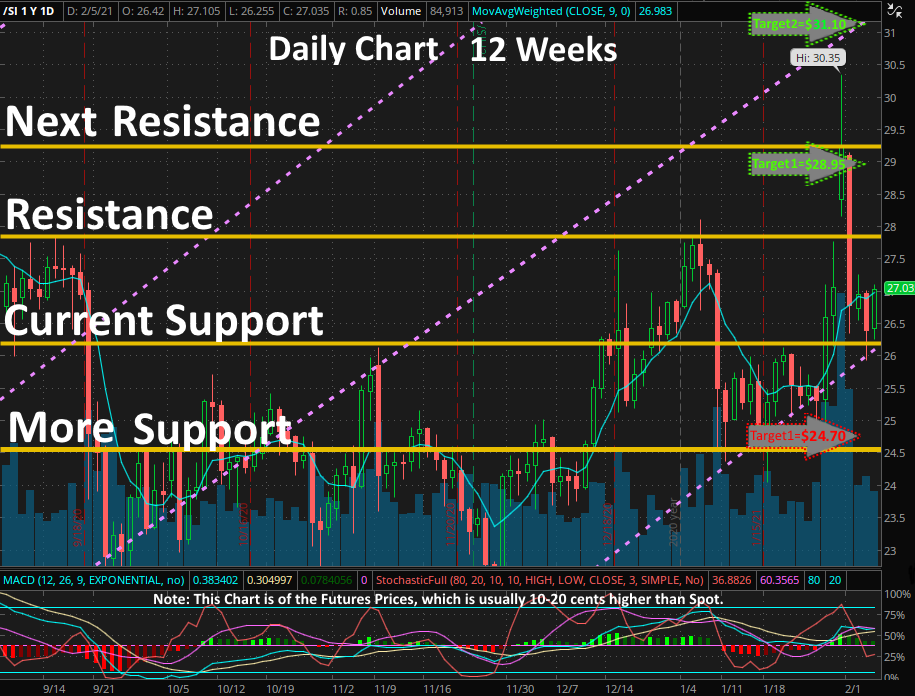

Sunday AM Vision: Week of February 7 - February 13, 2021

|

|

Sunday AM Vision: Week of January 31 - February 6, 2021

|

|

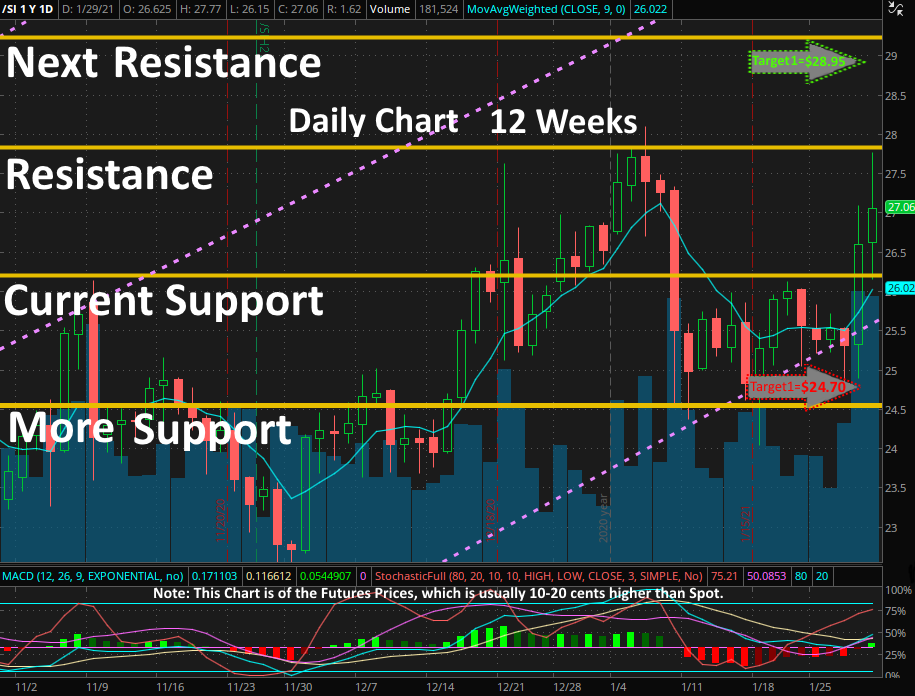

Sunday AM Vision: Week of January 24 - January 30, 2021

|

|

Sunday AM Vision: Week of January 17 - January 23, 2021

|

|

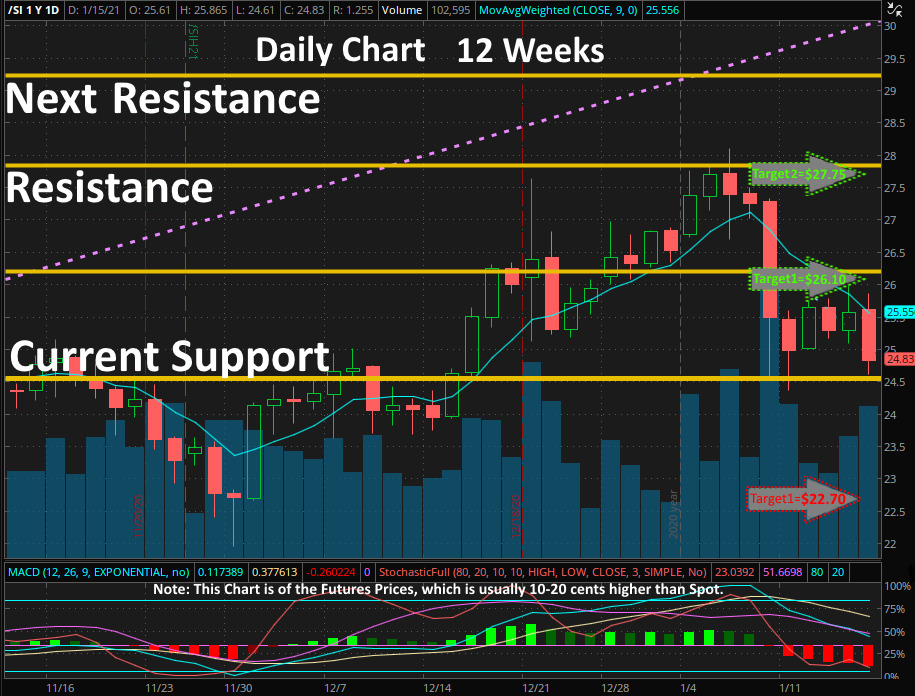

Sunday AM Vision: Week of January 10 - January 16, 2021

|

|

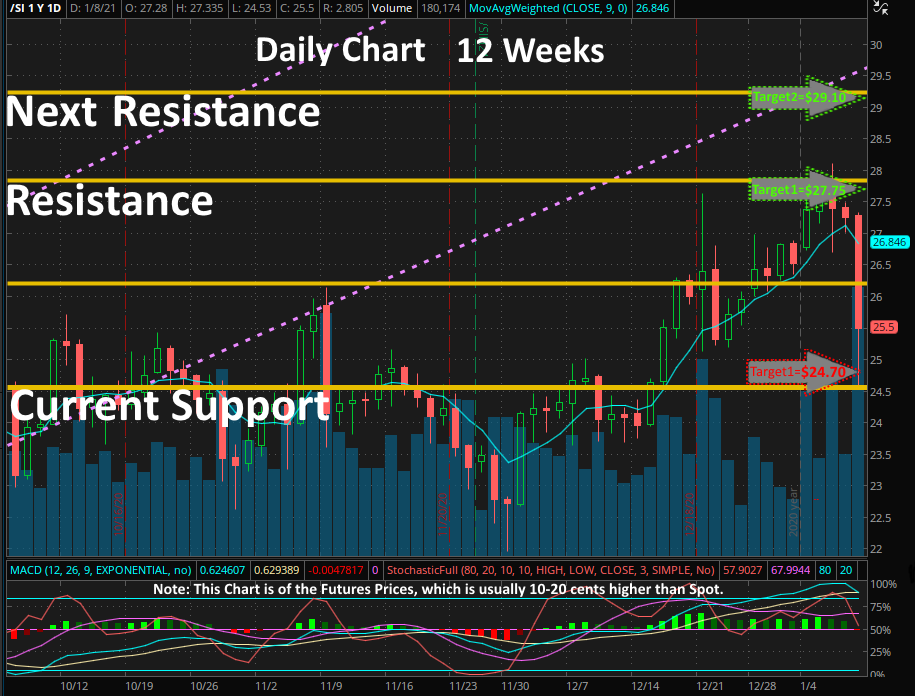

Sunday AM Vision: Week of January 3 - January 9, 2021

|

|

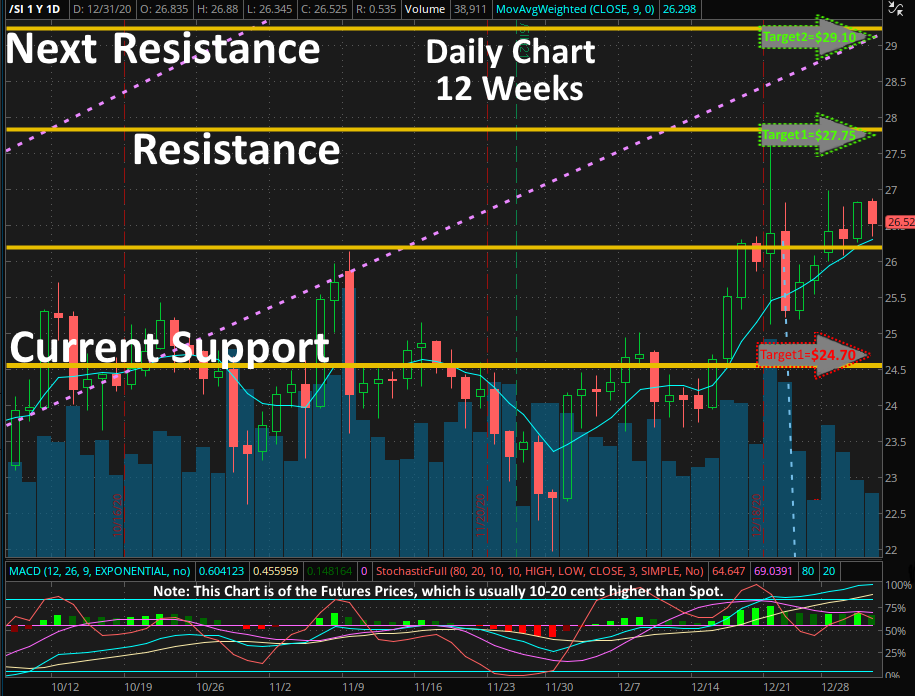

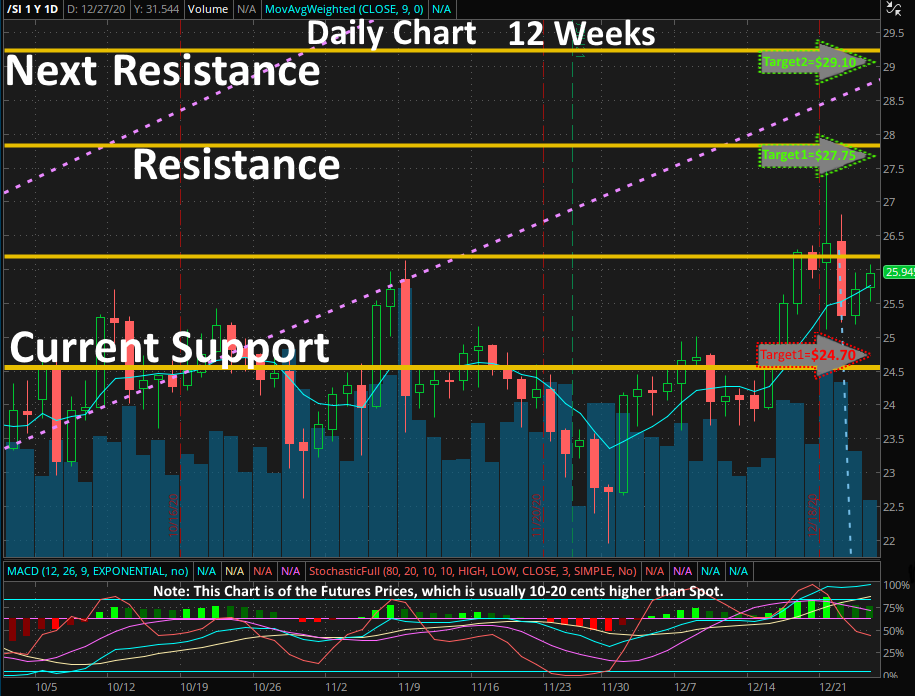

Sunday AM Vision: Week of December 27, 2020-January 2, 2021

|

|

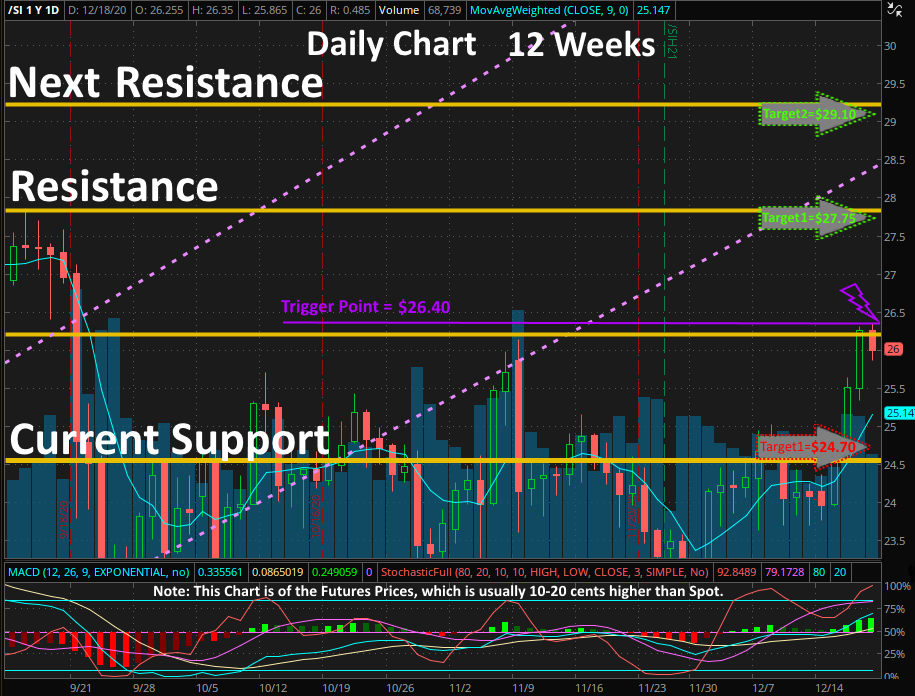

Sunday AM Vision: Week of December 20-December 26, 2020

|

|

Sunday AM Vision: Week of December 13-December 19, 2020

|

|

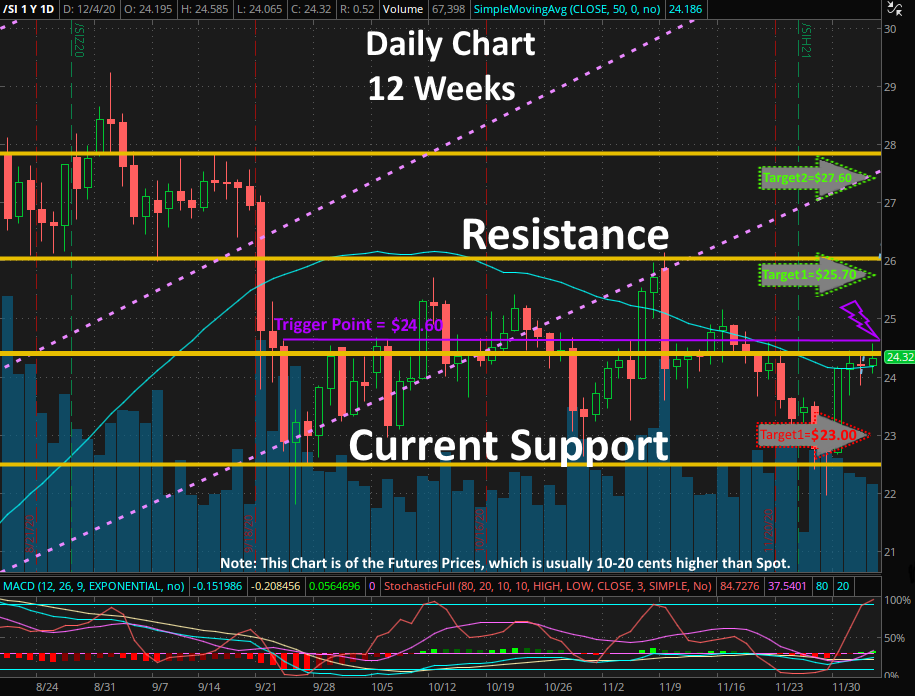

Sunday AM Vision: Week of December 6-December 12, 2020

|

|

Sunday AM Vision: Week of November 29-December 5, 2020

|

|

Sunday AM Vision: Week of November 22-November 28, 2020

|

|

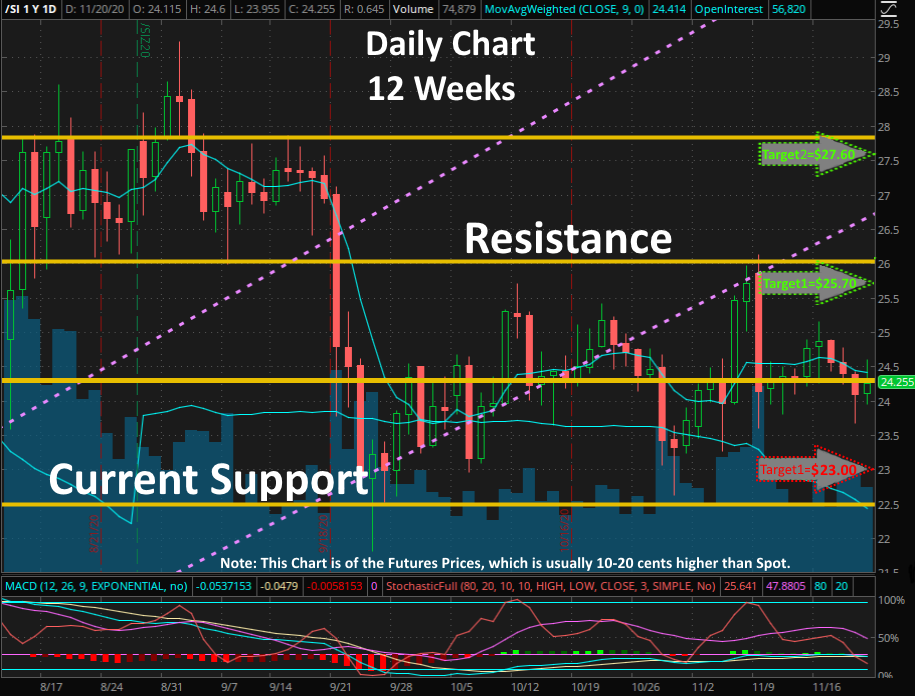

Sunday AM Vision: Week of November 15-November 21, 2020

|

|

Sunday AM Vision: Week of November 8-November 14, 2020

|

|

Sunday AM Vision: Week of November 1-November 7, 2020

|

|

Sunday AM Vision: Week of October 25-October 31, 2020

|

|

Sunday AM Vision: Week of October 18-October 24, 2020

|

|

Sunday AM Vision: Week of October 11-October 17, 2020

|

|

Sunday AM Vision: Week of October 4-October 10, 2020

|

|

Sunday AM Vision: Week of September 27-October 3, 2020

|

|

Sunday AM Vision: Week of September 20-September 26, 2020

|

|

Sunday AM Vision: Week of September 13-September 19, 2020

|

|

Sunday AM Vision: Week of September 6-September 12, 2020

|

|

Sunday AM Vision: Week of August 30-September 5, 2020

|

|

Sunday AM Vision: Week of August 23-29, 2020

|

|

Sunday AM Vision: Week of August 16-22, 2020

|